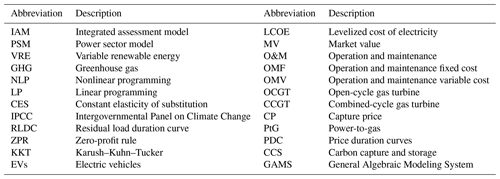

the Creative Commons Attribution 4.0 License.

the Creative Commons Attribution 4.0 License.

Bidirectional coupling of the long-term integrated assessment model REgional Model of INvestments and Development (REMIND) v3.0.0 with the hourly power sector model Dispatch and Investment Evaluation Tool with Endogenous Renewables (DIETER) v1.0.2

Falko Ueckerdt

Robert Pietzcker

Adrian Odenweller

Wolf-Peter Schill

Martin Kittel

Gunnar Luderer

Integrated assessment models (IAMs) are a central tool for the quantitative analysis of climate change mitigation strategies. However, due to their global, cross-sectoral and centennial scope, IAMs cannot explicitly represent the temporal and spatial details required to properly analyze the key role of variable renewable energy (VRE) in decarbonizing the power sector and enabling emission reductions through end-use electrification. In contrast, power sector models (PSMs) can incorporate high spatiotemporal resolutions but tend to have narrower sectoral and geographic scopes and shorter time horizons. To overcome these limitations, here we present a novel methodology: an iterative and fully automated soft-coupling framework that combines the strengths of a long-term IAM and a detailed PSM. The key innovation is that the framework uses the market values of power generations and the capture prices of demand flexibilities in the PSM as price signals that change the capacity and power mix of the IAM. Hence, both models make endogenous investment decisions, leading to a joint solution. We apply the method to Germany in a proof-of-concept study using the IAM REgional Model of INvestments and Development (REMIND) v3.0.0 and the PSM Dispatch and Investment Evaluation Tool with Endogenous Renewables (DIETER) v1.0.2 and confirm the theoretical prediction of almost-full convergence in terms of both decision variables and (shadow) prices. At the end of the iterative process, the absolute model difference between the generation shares of any generator type for any year is < 5 % for a simple configuration (no storage, no flexible demand) under a “proof-of-concept” baseline scenario and 6 %–7 % for a more realistic and detailed configuration (with storage and flexible demand). For the simple configuration, we mathematically show that this coupling scheme corresponds uniquely to an iterative mapping of the Lagrangians of two power sector optimization problems of different time resolutions, which can lead to a comprehensive model convergence of both decision variables and (shadow) prices. The remaining differences in the two models can be explained by a slight mismatch between the standing capacities in the real world and optimal modeling solutions based purely on cost competition. Since our approach is based on fundamental economic principles, it is also applicable to other IAM–PSM pairs.

- Article

(5097 KB) - Full-text XML

-

Supplement

(888 KB) - BibTeX

- EndNote

Thanks to decade-long policy support in many regions of the world and technological learning, the costs of both wind power and solar photovoltaics have plummeted (IEA, 2021; Lazard, 2021). These types of variable electricity generation are now highly cost-competitive against other alternatives, such that their deployment is increasingly driven by market forces instead of climate policies. Among the newly added renewable generations in 2020, nearly two-thirds were cheaper than the cheapest new fossil fuel (IRENA, 2020). Due to both cost declines and pressing concerns over climate change, investing in these clean and abundant resources has become a crucial part of national and regional strategies to decarbonize the power sector (The White House, 2021; Cherp et al., 2021; National long-term strategies, 2022; Rechsteiner, 2021; ICCSD Tsinghua University, 2022).

Given this dramatic development in the power sector over the past 2 decades, a universal consensus has emerged among energy transition scholars and policy makers: emissions in the power sector are relatively “easy-to-abate” (Luderer et al., 2018; Azevedo et al., 2021; Clarke et al., 2022). Compared with other primarily non-electrified end-use sectors such as buildings, transport and industry, the technologies required to transform the power sector are low-cost, mature and readily available. This trend has in recent years led to a second emerging consensus: the power sector will be the fundamental basis for a future low-cost, efficient and climate-neutral energy system (Brown et al., 2018b; Ram et al., 2018; Ramsebner et al., 2021; Luderer et al., 2022a). In addition to direct electrification, which requires end-use transformations of currently non-electrified demand, emerging technological developments in hydrogen and e-fuels produced from renewable electricity have also contributed to the broadening of potential technology portfolios for the “hard-to-abate” sectors, such as high-temperature heat and chemical productions (Parra et al., 2019; Bhaskar et al., 2020; Griffiths et al., 2021). Together, direct and indirect electrification supports a broad concept of “sector coupling”, which facilitates decarbonization by powering end-use demand with variable renewable energy sources (Ramsebner et al., 2021).

Due to the pivotal role of electrification and sector coupling in mitigation scenarios, there is an increasing demand on the scope and level of detail of energy–economy models used to guide energy transition and climate policies. The models would ideally encompass a global, multi-decadal and multi-sectoral scope such that the scenarios are relevant for international and regional climate policies while simultaneously incorporating a high level of spatiotemporal detail. The latter is important to account for the specifics of variable renewable electricity generation as well as its physical and economic interplay with the electrification of energy demand (Li and Pye, 2018; Brunner et al., 2020; Prol and Schill, 2021; Böttger and Härtel, 2022; Ruhnau, 2022). This need for improved modeling methods or frameworks, which has to overcome the trade-off between scope and detail, is a substantial methodological challenge. It entails realizing two main objectives.

-

Objective (1). Accurately model the power sector transformation over long time horizons in terms of investment and dispatch, especially at high shares of variable renewable energy (VRE) sources. Long-term pathways for the following power sector quantities and prices should accurately incorporate short-term hourly details:

- a.

capacity and generation mix of the power sector;

- b.

market values (annual average revenues per power generation unit) for variable and dispatchable plants;

- c.

capacity factors of the dispatchable plants and the curtailment rates of variable renewables; and

- d.

storage capacity and dispatch.

- a.

-

Objective (2). Accurately model direct electrification of end-use sectors as well as indirect electrification technologies such as green hydrogen production, where existing and emerging sources of power demand can in part be flexibilized.

1.1 Current modeling approaches and limitations

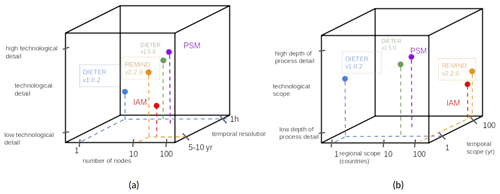

Current energy system models broadly fall into two distinct categories carried out by two research communities with little institutional overlap: integrated assessment models (IAMs) and power sector models (PSMs), each with their own strengths and weaknesses. IAMs are comprehensive models of a global scale and span multiple decades, linking macroeconomics, energy systems, land use and environmental impacts (Stehfest et al., 2014; Calvin et al., 2017; Huppmann et al., 2019; Baumstark et al., 2021; Keppo et al., 2021; Guivarch et al., 2022), thereby providing an “integrated assessment” of multiple factors (Rotmans and van Asselt, 2001). IAMs substantially shape the IPCC assessments of long-term climate mitigation scenarios and play an important role in policy making (Rogelj et al., 2018; UNEP, 2019; NGFS, 2022; IPCC, 2022). In comparison to IAMs, PSMs typically have narrower spatial and sectoral scopes and shorter time horizons but provide higher resolutions and increased technological detail (Palzer and Henning, 2014; Zerrahn and Schill, 2017; Brown et al., 2018a; Ram et al., 2018; Sepulveda et al., 2018; Blanford and Weissbart, 2019; Böttger and Härtel, 2022; Ringkjøb et al., 2018; Prina et al. 2020). (See also Sect. S5 in the Supplement for a comparison of model specifications of a few selected PSMs.) This allows PSMs to more accurately model the power sector under high-VRE shares (Bistline, 2021; Chang et al., 2021). Note that we use the term “power sector model” here to represent all general smaller-scope models than IAMs (usually by geographical or time horizon measures), even though many of them have sector-coupling aspects and do not only contain the traditional power sector.

IAMs and PSMs are therefore limited by a lack of spatiotemporal detail and a lack of scope, respectively. IAMs usually have a temporal resolution no shorter than a year (Keppo et al., 2021) and therefore include simplified representations of hourly power sector variability that mimic the real-world dynamics to varying degrees of success (Pietzcker et al., 2017). In general, a lack of high temporal resolutions can lead to difficulties when estimating the optimal level of variable renewable generation, often either overestimating or underestimating the market value of solar or wind generation, the challenges of variable renewable integration, the peak hourly residual demand, and the need for energy storage and base load (Pina et al., 2011; Haydt et al., 2011; Ludig et al., 2011; Kannan and Turton, 2013; Welsch et al., 2014; Luderer et al., 2017; Pietzcker et al., 2017; Bistline, 2021). While approximate methods such as parameterization via residual load duration curves (RLDCs) are able to capture the supply-side dynamics of VREs, they remain methodologically limited for representing the flexible demand-side dynamics (Ueckerdt et al., 2015, 2017; Creutzig et al., 2017). Besides limited temporal resolutions, IAMs also usually have coarse spatial resolutions, which can lead to underestimation or overestimation of transmission grid bottlenecks, geographical variability of wind and solar resources, and the flexibility requirements for balancing supply and demand (Aryanpur et al., 2021; Frysztacki et al., 2021; Martínez-Gordón et al., 2021). PSMs, on the other hand, usually lack the global and sectoral scopes required for addressing global climate mitigation, in part because of limited availability of detailed data and due to computational challenges. Furthermore, PSMs with a short-term horizon may lack the vintage tracking of standing capacities, capacity evolution over time and long-term perfect foresight, which can help policy makers and companies to look ahead beyond the short-term business cycles, to invest early and to actively drive technical progress. In contrast, in IAMs such as REMIND, proactive early investment is a built-in feature, because the optimization is done from a long-term social planner's perspective. In IAMs, investing early in the technological learning phase results in lower costs of energy expenditure later, avoiding the severity of punishment to economic growth later in time in the form of lower consumption, which raises the welfare which the model optimizes.

1.2 Iterative coupling for full model convergence

IAMs and PSMs differ in scope and resolution across the three main modeling dimensions: temporal, spatial and technological. A soft-coupling approach can tap into these complementarities and combine their strengths at potentially only a moderate increase in computational cost. The main challenge of the soft-coupling approach is to show that the two models can converge under coupling, which leads to a joint equilibrium that maximizes regional interannual intertemporal welfare in the IAM and minimizes total power system costs in the PSM. Ideally, the converged model offers the “best of both worlds”: it has both the broad scope required to assess global long-term energy transitions and the technical resolution required to capture the interplay between VREs, storage and newly electrified demand on a much shorter timescale.

Approaches aiming to bridge the “temporal resolution gap” between long-term energy system models and hourly PSMs have been proposed in the past (Deane et al., 2012; Sullivan et al., 2013; Alimou et al., 2020; Brinkerink et al., 2020; Seljom et al., 2020; Guo et al., 2022; Younis et al., 2022; Brinkerink et al., 2022; Mowers et al., 2023). While these achieved some aspects of Objective (1) with adequate results, none attempted to incorporate and achieve Objective (2). In addition, there is a methodological gap in the previous attempts at a full harmonization of the multiscale models. By a full harmonization, we mean a comprehensive coupling of the power sector dynamics and an eventual model convergence in capacities, generation and prices. In only a few previous studies, price information has been fed back into the long-term models from the short-term models: in one study only partial price information has been exchanged (Seljom et al., 2020) and in another study some subset of price information is exchanged, but they are not fully endogenized (instead, they are parameterized) and the exchange is also unidirectional (Mowers et al., 2023). Without a feedback mechanism through prices, the investment in the coupled model will very likely be suboptimal due to two effects. (1) Because of the misalignment in prices in the two models, there is a mismatch in investment incentives, resulting in a mismatch for optimal capacities if both models are completely endogenous. (2) In all previous studies, the capacities are fixed in the PSM, and only the long-term model is allowed to invest in new capacities. This implementation can further propagate and sustain the price mismatch due to (1) nontrivial shadow prices from these capacity bounds, in turn creating price distortions in the PSM that can be passed on to the IAM. Therefore, the methodological gap in previous work prevented a comprehensive convergence of the coupled models of both quantities and prices. As we show later in this study, without a comprehensive coupling of price information, no system-wide convergence can be achieved. However, with price coupling as our method proposes, we could achieve all aspects of Objective (1) and Objective (2) for one type of flexible demand with adequate numerical results, thereby representing a first step in bridging the previous methodological gap.

Compared to previous studies, our approach features three main innovations. (1) The coupling is achieved by linking market values and not hard-fixing quantities, allowing both models to invest “as endogenously as possible”. (2) The market values of all power sector technologies are coupled, not just the electricity price of the system or the market value of a particular technology, allowing models to achieve close to full convergence. (3) Under idealized coupling assumptions and for a simplified “proof-of-concept” model without storage, we can mathematically derive the necessary conditions under which comprehensive model convergence can be reached, which puts multiscale coupling on a firm theoretical footing. Our coupling approach is bidirectional, iterative and fully automated.

One should note that our methodology bears certain mathematical similarities to Benders decomposition from the discipline of operation research (Conejo et al., 2006), which is used in the long-term energy system model PRIMES (Price-Induced Market Equilibrium System) to obtain hourly detail (E3Mlab, 2018). There are however crucial differences. For example, the optimization in our work is carried out iteratively outside solver time, whereas the Benders decomposition is carried out iteratively during solver time. In addition, our approach can function even when the objective function is convex, whereas the Benders decomposition cannot, allowing our approach to be applied in more general cases. Mathematically, the subproblems in Benders decomposition have fixed capacities obtained from master problems and therefore are not endogenous, but the shadow prices of these constraints are iteratively passed on to the master problems, ensuring mathematical convergence. The exact ways in which our methodology is connected to Benders decomposition or other similar methods are yet to be fully explored.

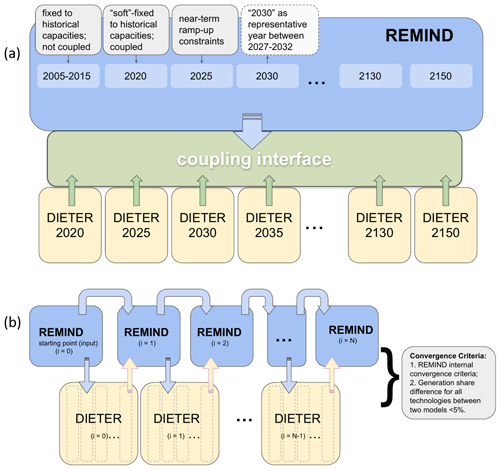

To showcase such a framework and its ability to achieve iterative convergence, we couple the PSM Dispatch and Investment Evaluation Tool with Endogenous Renewables (DIETER), which has an hourly resolution (8760 h in a year), with the IAM REMIND for a single region (Germany). Germany is a well-suited case study for exploring high VRE shares in the power sector. The country is expected to meet stringent climate targets despite its high level of residential and industrial power demand, relatively small geographical size, and lack of solar endowment during winter seasons. Nevertheless, the German government has set very ambitious targets for the expansion and use of variable renewable energy sources (Schill et al., 2022). A viable zero-carbon power mix in Germany must include an adequate amount of storage and transmission for renewable generation as well as “clean firm generation” such as geothermal, biomass or gas with carbon capture and storage (CCS) (Sepulveda et al., 2018).

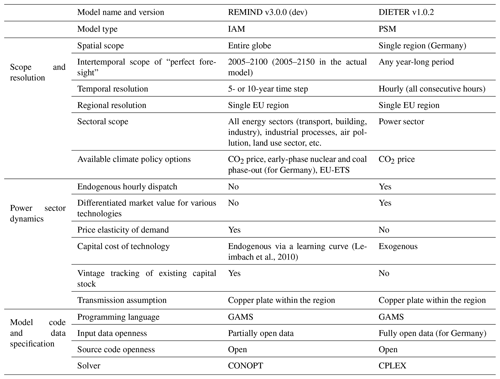

The models used in this study are well-documented open-source models (REMIND is an open-source model but requires proprietary input data to run). A side-by-side comparison of the scope, resolution and other specifications of the two models can be found in Appendix A. The coupling scope can be found in Appendix B. Details on model input data can be found in Sect. S1.

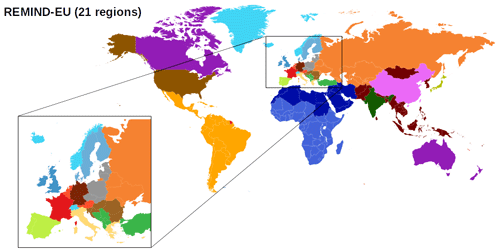

2.1 IAM: REMIND

REMIND is a process-based IAM that describes complex global energy–economy–climate interactions (Baumstark et al., 2021). REMIND has frequently been used in long-term planning of decarbonization scenarios, most notably in the IPCC (IPCC, 2014; Rogelj et al., 2018; IPCC, 2022). The REMIND model links different modules that describe the global economy, energy, land and climate systems to a relatively detailed representation of the energy sector compared to non-process-based IAMs. The model is formulated as an interannual intertemporal optimization problem. Due to the computational complexity of nonlinear optimization, the model simulates a time span from 2005 to 2100 with a temporal resolution of either 5 years (between 2005 and 2060) or 10 years (between 2070 and 2100). The years in REMIND are representative years of the surrounding 5- or 10-year period; e.g., year “2030” represents the 5-year period 2028 to 2032. Spatially, the model represents the world composed of aggregated global regions (Fig. B1). For each region, using a nested constant elasticity of substitution (CES) production function, the model maximizes interannual intertemporal welfare as a function of labor, capital and energy use (Baumstark et al., 2021). The macroeconomic projections of REMIND come from various established global socioeconomic scenarios jointly used by social scientists and economists – the so-called shared socioeconomic pathways (SSPs) (Bauer et al., 2017).

By default, REMIND runs in a regionally decentralized iterative “Nash mode” where all regions are run in parallel and the interannual intertemporal welfare is maximized for each region for each internal “Nash” iteration. Trade flows between the regions are determined between the Nash iterations. During the Nash algorithm, REMIND regions share partial information with each other, i.e., trade variables in primary energy products and goods. The Nash algorithm is said to converge when all markets are cleared and no region has an incentive to change its behavior regarding its trade decisions; i.e., no resources can be reallocated to make one region better off without making at least one region worse off. A successfully converged run of standalone REMIND in Nash mode usually consists of 30 to 70 iterations of single-region models in parallel. Each parallel single-region model usually takes 3–6 min to solve. A typical REMIND run in Nash mode lasts 2.5–6 h, depending on the level of sectoral details included. The latest version of REMIND (v3.0.0) is published as an open-source version on GitHub (release REMIND v3.0.0 ⋅ remindmodel/remind, 2022). REMIND is implemented as a nonlinear programming (NLP) mathematical optimization problem. In REMIND, the nonlinearity consists of the welfare function, the CES production functions, adjustment costs, technological learning, the extraction cost functions, the bioenergy supply function and nonlinear constraints, among others.

2.2 PSM: DIETER

DIETER is an open-source power sector model developed for Germany and Europe. In a long-running equilibrium setting (i.e., a competitive benchmark), the model minimizes the overall system costs of the power sector for 1 year. DIETER determines the least-cost investment and hourly dispatch of various power-generation, storage and demand-side flexibility technologies. In the previous literature, different versions of the model have been used to explore scenarios with high-VRE shares, where storage (Zerrahn et al., 2018; Zerrahn and Schill, 2017; Schill and Zerrahn, 2018), hydrogen (Stöckl et al., 2021), power to heat (Schill and Zerrahn, 2020) or solar prosumage (Say et al., 2020; Günther et al., 2021) are evaluated with a high degree of technological detail. DIETER recently also contributed to model comparison exercises that focused on power sector flexibility for VRE integration and sector coupling (Gils et al., 2022b, a; van Ouwerkerk et al., 2022).

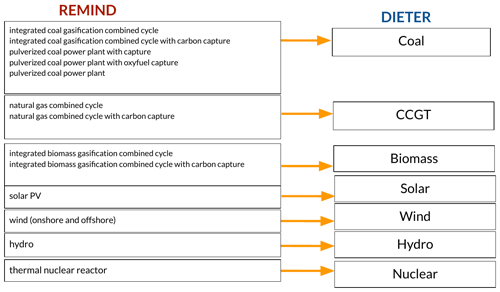

As a first step in building a model-coupling infrastructure, we implemented an earlier and simpler version of DIETER (v1.0.2) that is purely based on the General Algebraic Modeling System (GAMS). It has limited features in ramping constraints, flexible demand and storage. The model minimizes the total investment and dispatch cost of a power system for a single region considering all consecutive hours of 1 full year. The technology portfolio contains conventional generators such as coal and gas power plants, nuclear power as well as renewable sources such as hydroelectric power, solar photovoltaics (PV) and wind turbines. Endogenous storage investment and dispatch as well as demand flexibilizations are offered as additional features that can be turned on or off. DIETER, like many PSMs, is a linear program (LP). A typical standalone run (with essential features) lasts from several seconds to several minutes for a single region. See Zerrahn and Schill (2017) for detailed documentation of the initial model, which was implemented purely in GAMS. Later, DIETER's GAMS core was embedded in a Python wrapper for enhanced scenario analysis and postprocessing, but the model can still be run in GAMS-only mode (Gaete-Morales et al., 2021).

It is central to our approach that the price-based variables, such as the market values of electricity generation, are exchanged between the models. This approach ensures full convergence – including both quantity convergence and price convergence in the market equilibrium. Here, we first introduce the intuition behind this approach and then conduct a deep dive into the economic theory behind energy system modeling.

Economic concepts such as market values or capture prices (Böttger and Härtel, 2022), as key variables in our coupling, translate the physical characteristics of variable power generation or flexible consumption into economic ones. For example, generation technologies differ with respect to physical features and constraints – solar and wind generation depends on current weather conditions as well as diurnal and seasonal patterns, whereas this is less the case for dispatchable power plants such as coal, gas, biomass, nuclear or storage (López Prol and Schill, 2021). One consequence of this is that, for example, prices in hours where PV does not produce will essentially be set by other and usually more expensive forms of generation. In cost-minimizing PSMs, the shadow prices of the energy balance are interpreted as wholesale market prices (Brown and Reichenberg, 2021; López Prol and Schill, 2021). Therefore, in general, hourly resolution PSMs are well equipped to translate such physical constraints of generation into (wholesale) power market price time series. By providing such prices generated by PSMs (among other variables of the power sector dynamics) to IAMs, the latter can be indirectly informed about power market dynamics happening on much shorter timescales, even if they lack hourly resolutions. Over iterations, the prices from PSMs act as “price signals” to induce investment decision changes in IAMs, which can in turn provide feedback to the PSMs until the two models converge.

One innovation of our method is that the prices used for the model coupling can be symmetrically applied on the power supply side and on the demand side. On the supply side, the coupling method mainly utilizes the concept of a market value (i.e., the annual average revenue per energy unit of a generator) in a competitive market at equilibrium. Generally speaking, market values of generation usually convey the degree of variability intrinsic to a given source of power supply and reflect the generator's ability to meet an inflexible hourly demand, especially given the lower cost of variable generation compared to dispatchable technologies. Mirroring the concept of the market value, on the demand side, there is the concept of the “capture price” of electricity demand, which conveys the degree of demand-side flexibility. Note that there may be multiple terminologies for demand-side electricity prices; we use “capture price” to be consistent with one example of the literature on this topic. The capture price is the average electricity price that a flexible demand technology pays over a year. For example, flexible demand technologies such as heat pumps, electrolyzers or electric vehicles (EVs) can take advantage of electricity at hours when the generation is cheap in order to obtain a lower capture price, whereas inflexible demand has to pay a higher price on average. Price information given from a PSM to an IAM from both the supply and demand sides can change the IAM's inherent investment and dispatch decisions of power generation as well as inflexible and flexible demand-side technologies.

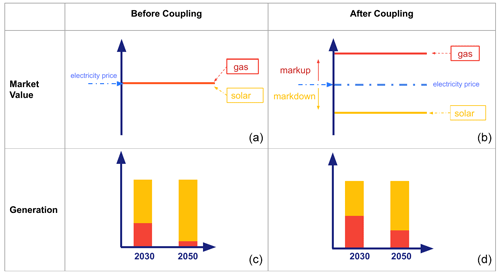

For an intuitive understanding of our innovative coupling scheme, we take the supply side as an example and use a toy model to visualize the approach of coupling via market values. The market values of electricity-generating technologies have been studied in depth (Sensfuß, 2007; Sensfuß et al., 2008; Hirth, 2013; Mills and Wiser, 2015; Hildmann et al., 2015; Koutstaal and va. Hout, 2017; Figueiredo and Silva, 2018; Hirth, 2018; Brown and Reichenberg, 2021). The general idea of the coupling is illustrated in Fig. 1 for a simplified case of only two types of generators – dispatchable gas turbines and solar photovoltaics with variable output. Note that we assume the system to be at a solar share of > 50 % and with no storage, such that the solar market value is below the average electricity price and that of gas generation is above it. Before the coupling, for a general IAM with coarse temporal resolution and without any VRE integration cost parameterizations, there is no differentiation between the market values of gas and solar generators – they are both equal to the electricity price. Thus, there is no differentiated revenue for 1 MWh generated by variable sources and dispatchable sources. The lack of market value differentiation is a direct consequence of the limited temporal resolution in IAMs, which cannot represent hourly dynamics. However, through a market-value-based coupling, the IAM can be informed by the PSM via a price “markup”. The annual price markup is defined as the difference between the market value of a specific technology and the annual average revenue that all generators together earn for one unit of generation (i.e., the annual average electricity price that a user pays). Under our soft-coupling approach, the markups from the PSM act as price signals that change the composition of the energy mix in the next iteration of the IAM. In this simple example with a lot of PV and no storage, since the gas generator can generate electricity in times of scarcity (night), it is “more valuable” to the system and thus will receive a positive markup. When this positive price incentive is transferred from the PSM to the IAM, it increases the optimal level of investment in gas generation in the next IAM iteration. At the same time, solar generation receives a negative price incentive, reducing the optimal level of investments in the next iteration. Ultimately, the higher market value of gas turbines is due to (1) their higher cost compared to solar (when gas is at < 50 % market share) and (2) their ability to set prices in hours of low solar output and inflexible electricity demand. As we later show through the mathematical theory of model convergence, other information besides markups also needs to be transferred, such as capacity factors (the annual average utilization rates of the generators).

Figure 1Schematic illustration of the coupling approach for a simple power system in an IAM with coarse temporal resolution, consisting of only gas and solar generators (no storage). (a, c) Before coupling; (b, d) after coupling. (a, b) Endogenous prices (electricity price, market values of solar and gas generators); (c, d) endogenous quantities (generation mix). The markups (as part of a larger set of interfaced variables) are the differences between market values and electricity prices and are given by the PSM of high temporal resolution as price signals to the IAM. Usually, it is called a “markup” when the market value is higher than the annual average electricity price and a “markdown” if it is the other way around. For simplicity, in the rest of the text we only refer to “markup” and “markdown” collectively as “markup”, regardless of whether the market value is higher or lower than the average electricity price.

There are several advantages to this new coupling approach centered on linking prices. First, instead of simply prescribing quantities such as yearly generation and capacities, the approach allows endogenous investment decisions to be made by both models as they converge towards a joint solution. This gives maximal freedom to the coupled models while minimizing unnecessary distortions from one model to the other when some necessary quantities are being prescribed. Second, our coupling scheme provides an elegant treatment of both supply- and demand-side technologies using the concepts of market values on the one hand and capture prices on the other. Third, from a theoretical point of view, transferring the market values of all the generation types in a system alongside mappings of other relevant system parameters can lead to a convergence of the solutions of the two models under idealized coupling circumstances. It can be rigorously shown that our method contains an exhaustive list of interfacing parameters and variables for full model convergence of both quantities and prices. To the best of the authors' knowledge, the last point has not been explored or shown in any previous work.

In certain IAMs, VRE integration cost parameterization has been implemented to mimic the economic consequences of variability of VREs, especially when the models have a lower temporal resolution. Such VRE integration costs are contained in the uncoupled default REMIND power sector modeling. However, the exact parameterization always depends on a particular set of technological costs and parameters which might be subject to changes (Pietzcker et al., 2017), and the parameterization often needs to be carried out anew under new assumptions and scenarios. In contrast, the model-coupling approach is more general, and no such bespoke parameterization is needed.

Inspired by the theoretical framework based on the Karush–Kuhn–Tucker (KKT) conditions for power sector optimization problems (Brown and Reichenberg, 2021), we develop the theoretical basis for the coupling method in this section, which we use for validating convergence in numerical coupling in later sections. In Sect. 3.1, we analytically formulate the fundamental economic theory of the coupling approach. We first introduce the power sector formulations in the two uncoupled models (Sect. 3.1). Then we carry out a derivation of the convergence conditions and criteria, where we map the Lagrangians of the two power sector problems at different time resolutions and derive the equilibrium condition for the coupled models (Sect. 3.2). In Sect. 3.3, we introduce the iterative coupling interface which contains all the previously derived convergence conditions. For REMIND information being passed on to DIETER (Sect. 3.3.1) and DIETER information being passed on to REMIND (Sect. 3.3.2), we list and define the variables and parameters being exchanged at the interface as well as additional constraints and implementations which serve to improve the coupling.

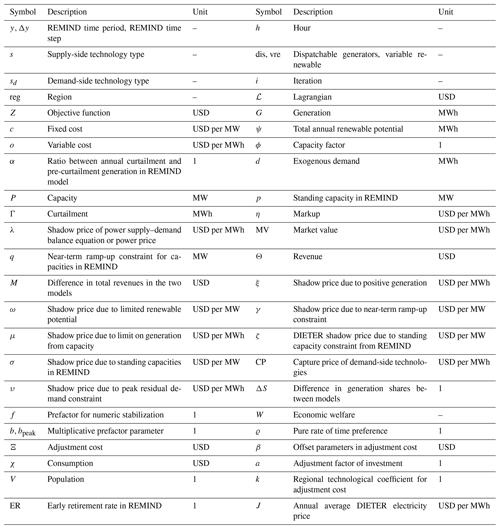

Complete lists of the mathematical symbols and abbreviations can be found in the Appendices.

In the following sections, we first formulate the two uncoupled models and then move on to discussing coupled models. The theoretical tools we develop here are the foundation for the numerical implementation of coupling and serve to validate and assess the model convergence in the Results section.

3.1 Descriptions of uncoupled models

REMIND and DIETER are both optimization models. REMIND maximizes interannual global welfare from 2005 to 2150, whereas DIETER minimizes the power sector system cost for a single year and a single region. For a given REMIND Nash iteration (see Sect. 2.1), the single-region economy is in long-term equilibrium after the optimization problem is solved. Since, given a fixed national income, lower energy system costs mean higher consumption, which leads to increased welfare (see Appendix C for details), maximizing welfare can be assumed to correspond to minimizing energy system costs, a part of which is power sector costs. Therefore, to reduce the complexity of our analysis, we formulate an uncoupled REMIND model based solely on the power sector cost minimization and not the total welfare maximization. For the standalone REMIND, the multi-year power system cost for a single region equals the sum of all variable and fixed costs of generation,

where c represents the fixed cost for capacity, o represents the variable cost of running power generation, P denotes endogenous capacity, and G denotes endogenous generation (defined as including curtailment in REMIND). P and G are the decision variables of the problem. The sum in the objective function is over time index y and power-generating technology type s. The REMIND time index y stands for 1 representative year, which represents 5 or 10 years centered around it. So, even though the time step is 5 to 10 years, the time resolution is 1 year. For example, “y=2020” represents the years 2018–2022. Capital letters (both Latin and Greek) denote independent decision variables of the optimization problem. We classify an endogenous decision variable as independent if it is not uniquely determined by one or more other decision variables and has no binding constraints applied to itself that are not already accounted for by the constraints on the decision variable(s) it depends on. Note that, for simplicity, we treat all costs in REMIND in this formulation as if they are exogenous. In reality, REMIND has endogenous fixed costs due to technological learning as well as an endogenous interest rate. Some types of variable costs such as fuel costs are also endogenous and are determined based on primary energy balance equations for oil, gas and biomass. CO2 prices can also be endogenous under emission constraints.

Under the simplifying assumptions made for the derivation in this paper, the only independent decision variables are capacities, generations and curtailments. Small letters denote either exogenously given parameters or endogenous shadow prices.

For standalone DIETER, which has a year-long time horizon, the power system cost is

where is the endogenous hourly power generation (excluding curtailment – note that this is different from the generation variable definition in REMIND), h is the hourly index in a year from 1 to 8760, and s is the index for the power-generating technology in DIETER. is hourly curtailment, only applicable in the case of variable renewables vre (vre⊂s). Technology type s can be subdivided into two subsets: vre and dis (“dispatchables”). For simplicity, we abbreviate the index subscript from s|s=vre to vre and from s|s=dis to dis. Here, in order to differentiate from REMIND notations, we use overline to denote DIETER parameters and variables. Note that, for simplicity, in the derivation we treat the technology types in both models as identical, although in fact the technologies in the two models are not one-to-one mapped (Fig. B2). During the coupling all interface parameters and optimal decision variables need to be upscaled or downscaled when transferred from one model to the other.

The cost minimization of the total power sector cost Z and under constraints yields the optimal values of the decision variables, denoted as (, ) and (, , .

Without coupling, and under a baseline scenario, there are several constraints for each model. In the following equations we denote the shadow price (i.e., the Lagrangian multiplier) of a constraint by the symbol following ⟂. We use small Greek letters to denote endogenous shadow prices and small Latin and Greek letters to denote exogenous parameters. The major constraints are as follows (“c” stands for “constraint”).

- c1.

Constraint on generation for meeting demand, a.k.a. “supply–demand balance equation” or “balance equation” for short:

where dy denotes the annual REMIND power demand and denotes the DIETER hourly demand. The shadow prices (Lagrangian multipliers) λy and represent the annual and hourly electricity prices in REMIND and DIETER, respectively, and are equal to the marginal cost of one additional unit of electricity generation. αy,s is the annual VRE curtailment ratio in REMIND. Note that, technically speaking, REMIND electricity demand dy is determined endogenously, partially via competition with other energy carriers at the final energy consumption level, such as the competition between electricity and gaseous carriers such as natural gas or hydrogen in household heating. However, because here we have reduced REMIND to only intra-power sector dynamics for the purpose of mathematical analysis, we treat demand as exogenous.

- c2.

Constraint on maximum capacity by the available annual potential ψs in a region:

Note that the resource constraint in REMIND is only relevant for wind, solar and hydro and is assumed to be constant over the model horizon. Biomass availability is not modeled via a regional potential constraint. Instead, the availability of biomass is priced in through the soft-coupling to the land use model MAgPIE via a supply curve.

- c3.

Constraint on generation being non-negative:

Note that there are several other similar constraints on other positive variables such as capacities and curtailment. In practice, during the derivation they behave similarly to this positive generation constraint. Therefore, for simplicity, we do not include them in the derivation.

- c4.

Constraint on maximum generation from capacity:

where ϕy,s is the exogenous annual average capacity factor of the power plant s in REMIND in year y and is the exogenously given hourly theoretical capacity factor (i.e., before curtailment) of VRE in DIETER. Note that, strictly speaking, curtailments in the uncoupled REMIND and DIETER are endogenous decision variables but are not independent variables. However, here we use capital letters to denote hourly curtailment in DIETER as an independent decision variable to account for curtailment costs and other curtailment constraints that can arise from a more general formulation of the model.

- c5.

“Historical” constraints on capacities in REMIND. This makes REMIND a so-called “brown-field model”, i.e., a model accounting for the standing capacities in the real world. Past capacities (y< 2020) are “hard-fixed”; i.e., the variable capacities are fixed to certain numeric values. Current capacities (y=2020) are “soft-fixed”; i.e., the variable capacities are fixed to a corridor around certain standing numeric values: the lower bounds guarantee the already planned capacities, and the upper bounds reflect the finite physical capabilities of scaling up, defined by 5 % above the 2020 real-world data. For simplicity, we use only one constraint for both past and current capacities,

where py,s represents the standing capacities of technology s at time y in REMIND in the past and present years.

- c6.

Near-term upscaling constraint on VRE capacity expansion, represented by an upper bound on near-term capacity addition in model period , , where Δy is the REMIND model time step:

where qy,s is equal to twice the added capacity during the 2010–2020 period (only applied to Germany in the default REMIND).

Note that constraints (c5) and (c6) introduce interannual intertemporality into the power sector of REMIND. This additional interannual intertemporality determines that the model equilibrium can only be strictly satisfied across the sum of all the model periods and not for a single period. Another source of intertemporality in REMIND is the adjustment cost, which we ignore in the main text of this study since it introduces nonlinearity into the power sector and also plays a relatively small role in the overall dynamics.

Note that, regarding the simplification of REMIND above, to the best of the authors' knowledge, there is no theoretical or empirical concept that addresses the validity of drawing equivalence between welfare maximization and energy system cost minimization in IAMs. Naively, given that the gross domestic product (GDP) is unchanged, decreasing energy system costs raises consumption and therefore welfare. However, this is only valid under the assumption that energy is a substitute for (and not a complement to) capital and labor; i.e., one usually cannot raise economic output (GDP) simply by spending more on higher energy expenditure (while satisfying the same level of energy demand). Nevertheless, this is likely a necessary condition and not a sufficient one for proving the equivalence. More theoretical research will be needed to draw a precise and rigorous equivalence. However, in practice, we see that during our numerical calculation the model is well behaved according to this reduced theory, which means that the parameters in the models are in a regime where such an assumption is valid, at least in the case of IAM REMIND.

3.2 Economic theory of model convergence

In the last section we discussed the standalone uncoupled power sector formulations in REMIND and DIETER. In this section we discuss the coupled models and their convergence. Under simplified assumptions, we first derive the mapping between the models that is necessary for a convergence (Sect. 3.2.1 and 3.2.2), and then we derive theoretical relations that are later used to validate the numerical results of the coupled run (Sect. 3.2.3).

3.2.1 Derivation of convergence conditions

Our aim is to develop a method under which comprehensive convergence can be reached for soft-coupled multiscale models. We achieve this by deriving a mapping of the two problems such that their decision variables have identical optimal solutions and the endogenous shadow prices are also equal across the models. The convergence conditions of the coupled REMIND–DIETER model for the power sector are the result of such a mapping. Below, we first define what is meant by a “comprehensive model convergence” and then sketch the workflow of the derivation of a coupling framework which would result in a comprehensive model convergence of both decision variables and shadow prices. The detailed derivation is in Appendix D.

Here, we derive the conditions under which the endogenous decision variables are identical at each model's optimum, i.e., and – or, equivalently, pre-curtailment generation and . A convergence of the solutions of these two sets of annual decision variables for each technology s and for each year y, along with the convergence of shadow prices, gives rise to comprehensive model convergence. We show below that this can only be achieved if there is a harmonization at the level of the KKT Lagrangians of the two problems, following the methods first developed by Karush, Kuhn and Tucker (Karush, 1939; Kuhn and Tucker, 1951).

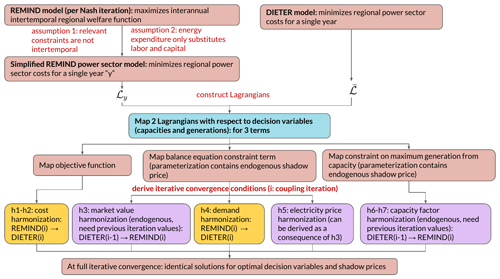

Our coupling approach fundamentally relies on mapping the parameterization of the Lagrangians for both optimization problems. It is trivial to show that, as long as the KKT Lagrangians are identical with respect to the decision variables, the solutions of the problem are identical, e.g., if an optimization problem A has Lagrangian and another problem B has Lagrangian , where x and y are decision variables of the optimization problems. Then, if we let , the two problems are identical, and they must have identical optimal solutions for the decision variables x* and y*. This is the basic logic behind the Lagrangian-based method. The challenge in the case of REMIND and DIETER is to show that when a decision variable representing the same physical quantity, for example, the annual power generation from a technology, is defined with low resolution in one problem and high resolution in another, there is nevertheless a viable mapping between the two Lagrangians. In this case, the parameterization of the Lagrangian is not only limited to exogenous parameters of the model, but also includes endogenous shadow prices and endogenous decision variables from the other model. Due to the endogenous nature of the latter two, the parameterization in the current-iteration model A must come from the solved results from the last iteration from model B and vice versa. Figure 2 illustrates the workflow of the analytical derivation of the convergence conditions.

Figure 2The schematics of the Lagrangian-based derivation procedure for a simplified version of REMIND–DIETER iterative convergence. After simplifying assumptions, we can construct the Lagrangians of the reduced REMIND model and the full DIETER model for a single year (Eqs. 3–4). Comparing and mapping terms in the Lagrangians (a key step in bold), we discover that iterative exchange of a broad range of information is needed for a fully harmonized parameterization of the Lagrangians. Under the harmonization specified in the seven convergence conditions (color-coded for directions of information flow), the coupled models can give rise to identical optimal solutions of the models' respective (annually aggregated) decision variables and hence a full quantity convergence. The necessary shadow price convergence is shown in the detailed derivation of the harmonization conditions (h1–h7) in Appendix D.

The analytical derivation workflow, as shown in Fig. 2, is described in detail as follows. First, we apply simplifying assumptions to reduce the complexity of the uncoupled models (before the key step in blue in Fig. 2). Assumptions have to be made to justify reducing the scope of the REMIND model, such that for the purpose of the analysis it is on equal footing to DIETER. We achieve this by reducing the global REMIND model to a single sector (the power sector), single year and single region. To reduce the REMIND model from a macroeconomic–energy model to a power-sector-only model, we make similar assumptions to before when formulating the uncoupled REMIND power sector (see Sect. 3.1). To reduce the REMIND model further to a single year, we assume that the models only contain constraints in the power sector that are not intertemporal; i.e., we ignore the brown-field and near-term constraints for now. Since for each iteration of the REMIND model in Nash mode interregional trading happens between the iterations, the single-iteration optimization model is already for a single region and therefore does not require simplification. After these simplifying steps, in this part of the derivation, we can treat REMIND's power sector as “separate” from the rest of the model and treat the dynamics of a single year in REMIND as independent of the dynamics of other years. Later, the numerical results of the convergence can confirm to a large degree the validity of these assumptions, especially in the green-field temporal ranges, i.e., where the intertemporal brown-field constraints have little influence on the dynamics. Note that, with the inclusion of these intertemporal constraints in the derivation, the mapping becomes more complicated, especially for the near-term range, i.e., before 2035. So, in practice, this derivation of the coupling interface is only an approximation of what is needed for a full convergence of DIETER and REMIND, since it deliberately ignores such constraints. See also Sect. 6.1.

After the necessary simplification assumptions, we construct the Lagrangians for the simplified model REMIND and for DIETER (after the blue block in Fig. 2) (Gan et al., 2013). For a single-year reduced REMIND power sector model, the Lagrangian is

We would like to map it to the single-year DIETER Lagrangian :

The algebraic derivation of mapping the two Lagrangians term by term is presented in Appendix D. From this algebraic mapping, we can derive seven harmonization conditions (h1–h7) required for a full convergence. Conditions (h1)–(h7) are the subsequent basis for most of the information exchanged at the coupling interface. Among them, conditions (h3) and (h5)–(h7) (purple blocks in Fig. 2) indicate conditions which contain endogenous information that must come from the previous iteration of DIETER that is passed on to REMIND, such as markup and capacity factors. Conditions (h1)–(h2) and (h4) (yellow blocks) indicate conditions which contain information that comes from the previous iteration of REMIND and is passed on to DIETER. For schematics of the coupled iterations, see Appendix E.

This Lagrangian-mapping-based derivation can theoretically show that our approach (in its simplest form) necessarily leads to model convergence and has the advantage of being mathematically straightforward and rigorous. The necessary information from the power sector dynamics is all contained in the list of conditions derived from such a mapping. If the coupling contains less information, a convergence is not possible; at the same time, for a model convergence, one does not need to pass on any additional information beyond what is contained in this list of conditions. The list of information derived here is therefore complete and exhaustive for a coupled convergence.

3.2.2 List of convergence conditions

The convergence conditions (h1–h7), which are derived in detail in Appendix D following the procedure in Sect. 3.2.1, are summarized here.

- h1.

Annual fixed costs are harmonized: .

- h2.

Annual variable costs are harmonized: .

- h3.

Annual average market values for each generation type s are harmonized via markups from DIETER. We let denote the markup for technology s in year y in the last-iteration DIETER, i.e., the difference between the market value and the annual average price of electricity.

This is the heart of our coupling approach, using markups as the price signals. Intuitively, the markups represent the market value differences between REMIND and DIETER. The harmonization of market values is implemented by iteratively adjusting the market value for each generator type in REMIND to be the same as that in DIETER. As long as the market values (or per-unit-generation revenues) and costs are harmonized, the economic structures of the power market are identical and the models can converge.

Using markup Eq. (5), we modify the original objective function Z in the coupled version of REMIND by subtracting the product of markups and generations summed over all technologies and all years:

where Z′ is the modified REMIND objective function in the coupled version, and i is the iteration index of the iterative soft-coupling.

- h4.

Annual power demands are harmonized: .

- h5.

Annual average prices of electricity are harmonized:

where (i−1) indicates that the endogenous results are from the last iteration. This is shown in Appendix D to be a direct consequence of (h3) and (h4).

- h6.

Annual average capacity factors for each generation type s are harmonized:

where is the hourly capacity factor in DIETER, determined by endogenous hourly generation and annual capacities in the last iteration.

- h7.

Annual curtailments are harmonized:

In mapping the Lagrangians (Eqs. 3–4), except for the objective function, the rest of the parameterization contains endogenous shadow prices and endogenous quantities. Since endogenous values can only be known ex post, this imposes a strict requirement on the coupling that it must be iterative, with the endogenous part of the parameterization coming from previous iteration optimization results – usually from the other model. The mapping of the endogenous information requires careful argument in each case (i.e., the derivation of h3–h7). In the case of the balance equation constraint Lagrangian term (corresponding to c1), the shadow prices of the constraint in the current-iteration REMIND model are exogenously corrected by a set of technology-specific markups (see the introduction in Sect. 3.1), such that the new “corrected” market value in REMIND is manipulated to match the market value of the previous iteration of DIETER. This is the heart of our coupling approach using markups as the price signals. In the case of the constraint on maximum generation from capacity (corresponding to c4), the endogenous shadow prices in the current iteration REMIND can be shown to be automatically mapped to those in the previous iteration of DIETER given that the annual average capacity factors in the constraints are harmonized (h6–h7).

In actual implementation, most of the above mappings are modified for numerical stability (Sect. 3.3.2, Appendix H).

3.2.3 Theoretical tools for validating convergence

Here we first state the convergence criteria, which are mathematical relations that are being satisfied under model convergence. Then we also discuss equilibrium conditions of the coupled models that alongside the convergence criteria can be used to check numeric results to validate and assess the convergence outcome.

Under a theoretical full convergence of the coupled model,

- v1.

annual average electricity prices,

- v2.

capacities and

- v3.

(post- or pre-curtailment) generations

should all be identical at the end of the coupling in both models. These are the most important criteria by which we validate full model convergence. Technically, electricity price convergence (v1) (i.e., convergence condition h5) can be derived from (h3) to (h4). Nevertheless, we check this ex post, together with quantity convergence (v2–v3). In actual coupled model runs, following only the convergence conditions (h1–h7), the convergence criteria (v1–v3) might not be exactly fulfilled. Therefore, in practice, in order to validate the degree of numerical convergence, the alignment between REMIND and DIETER generation shares is set to be within a few percentage points before coupled runs terminate.

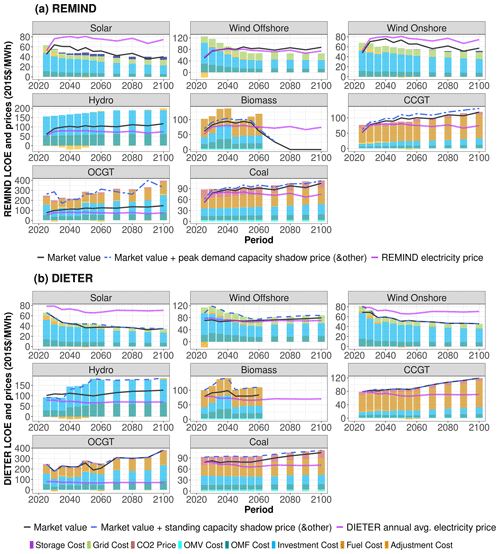

Besides using convergence criteria (v1–v3), we also use a type of equilibrium condition – the so-called “zero-profit rules” (ZPRs) – to validate the numerical model convergence. ZPRs are mathematical relations which state that, under market equilibrium, prices are equal to the costs for electricity. This is not always the case, especially in situations where there are extra constraints on the model that distort this equality. ZPRs contain model parameters and decision variables at market equilibrium, and they can be derived from the KKT conditions of the model (Appendix F). ZPRs are therefore reliable tools in ascertaining the sources of market values or the price of electricity of the power sector because, according to the ZPRs, one can always decompose the prices into the cost components, i.e., so-called levelized costs of electricity (LCOEs). The decomposition of prices into cost components is important because the prices of electricity in the power market are overdetermined by the energy mix, so it is possible that two different power mixes correspond to the same electricity price. In numerical results, a slight mismatch of the energy mix at the end of the coupling is unavoidable, so, alongside comparing the prices, it is often helpful to compare the makeup of the LCOEs across the models, such that they also appear harmonized at the end of the iterative convergence. Overall, ZPRs are a helpful tool for visualizing and understanding the power market dynamics, both from the point of view of each generator type and from the point of view of the entire electricity system. It is worth noting that the ZPRs, which are mathematical conditions derived from an idealized modeling of the power sector as fully competitive, are only an approximation of the real-world markets, where firm profits exist. ZPRs in their technical definition simply mean that, at model equilibrium, cost equals revenue. Given that the profits are defined as the difference between revenue and cost, the profits are zero in this situation. The name “zero-profit rule” therefore should not be overinterpreted beyond its technical contents, and one should be aware of its theoretical origin and the assumptions under which it is valid.

The ZPRs of the coupled model can be derived based on (1) the uncoupled models, (2) the modification made to the model due to the coupling interface (h1–h7) and (3) any additional modifications made to the model during our numerical implementation. In the last category, for a complete numerical implementation of the coupling, we add one additional capacity constraint, i.e., (c7) and (c8) for each model. The first capacity constraint (c7) is created in REMIND to circumvent the issue of extremely high markups from peaker gas plants in the scarcity hour of the year in the DIETER model, which otherwise causes instability during the iterative coupling. The second constraint (c8) is a simple brown-field constraint implemented in DIETER to address the fact that DIETER is a green-field model that is otherwise ignorant of standing capacities in the real world. For simplicity, (c7) and (c8) are not included in the convergence condition derivations in Sect. 3.2.1. The derivations of the ZPRs outlined by the above three steps have been carried out in Appendix F (uncoupled models), Appendix G (coupled REMIND only including the coupling interface, coupled DIETER including constraint c8) and Appendix H (coupled REMIND, including constraint c7).

In summary, the ZPRs for both coupled models are as follows.

- a.

Coupled REMIND

- i.

Technology-specific ZPR:

- ii.

System ZPR:

- i.

- b.

Coupled DIETER

- i.

Technology-specific ZPR:

- ii.

System ZPR:

- i.

The prime sign indicates that the term has been modified from the uncoupled versions due to implementation in the coupling. ν and ζ are capacity shadow prices introduced from the additional constraints (c7–c8) (Appendices G–H). It is worth noting that constraints (c7)–(c8) introduced due to coupling can impact the Lagrangians of the two models which we used to derive convergence conditions and criteria. However, in actual coupled runs, evidently there is only a moderate distortion due to these extra constraints. Condition (c8) even helps with convergence because it also puts most of the brown-field and near-term constraints which REMIND sees into DIETER (see Sect. 6.1).

Due to the fact that several sources of shadow prices cannot be incorporated during the derivation for convergence (Sect. 3.2.1), in numerical experiments of the coupled run it is appropriate to compare the following two types of prices across the two models for price convergence:

-

electricity price convergence, not including any capacity shadow prices;

-

sum of electricity prices and all respective capacity shadow prices converging.

Under the simplified analysis of convergence (discounting brown-field constraints, scarcity prices, etc.), price convergence in (1) is predicted by theory (see also convergence condition h5). However, this is only under the most idealized situation. Convergence in (2) on the other hand includes all the prices, which should match if LCOEs match across the system. We use the first type to check price convergence over iteration and use the second type only in the context of checking the system ZPRs across the models because of the theoretical relations between full prices and LCOEs.

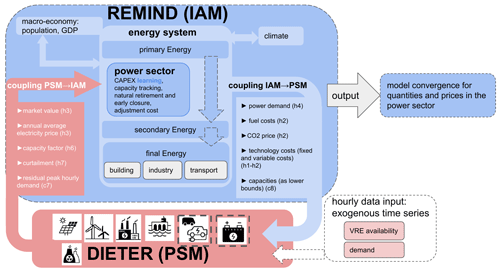

3.3 Implementation via interface: exchange of variables

In this section we list parameters and endogenous variables that are exchanged between REMIND and DIETER. This already satisfies most convergence conditions, while the remaining condition (h5) is checked in Sect. 4 as part of the convergence criteria (v1–v3). An overview of the model coupling and the flow of information under convergence conditions is shown in Fig. 3.

Figure 3The schematics of the REMIND–DIETER iterative soft-coupling. The power sector module of IAM REMIND, which is between the layer of primary-to-secondary energy transformation, is hard-coupled with other modules inside REMIND such as macro-economy, industry and transport. In PSM DIETER, the power market with generators of various types is modeled with hourly resolution, with options for storage and flexible demand. The information exchanged between the models (block arrows) is determined via the convergence conditions (h1–h7) derived before (Sect. 3.2.1). In order to improve performance and facilitate convergence, additional constraints (c7 and c8) are included in the coupling interface. The coupling interface for REMIND to DIETER is programmed as part of modified DIETER code and vice versa. Both interfaces are written in GAMS. For a single region, the scheduling of coupled iterations is illustrated in Fig. E1 in Appendix E. Sixteen DIETER optimization problems are solved for each representative year of REMIND in parallel, scheduled after each internal REMIND Nash iteration (see Sect. 2.1 for a description of the iterative Nash algorithm).

During the coupling, the following exchanges of parameters and variables take place iteratively in both directions via the interface.

3.3.1 REMIND to DIETER

The following information flow is from REMIND to DIETER.

-

Technology fixed costs (convergence condition h1)

- a.

Annualized capital investment cost: this is calculated from the endogenously determined overnight investment cost, plant lifetime and the endogenously determined interest rate. The overnight investment cost is determined from floor cost, learning rate and the endogenous global accumulated deployment. Note that investment costs decrease according to the endogenous learning rate. The interest rate is about 5 % on average but is endogenous and time-dependent in REMIND.

- b.

Annualized operation and maintenance (“O&M”) fixed costs (OMF): they are a fixed share of the capital costs.

- c.

Adjustment cost: this is technology-specific and is proportional to the capital investment cost. See Appendix I for its implementation.

- a.

-

Technology variable costs (convergence condition h2)

- a.

Primary energy fuel costs: they are endogenously determined as the shadow prices of the primary fuel balance equations in REMIND. Import prices, domestic prices of extraction, the amount of regional reserves and the amount of fuel demand can all influence the fuel cost. The relevant fuel costs include coal, gas, biomass and uranium. The fuel costs can have interannual intertemporal oscillatory components which can cause instability during iteration if coupled directly. We mitigate this by conducting a linear fit to the time series before passing them on to DIETER.

- b.

Conversion efficiency of each generation technology

- c.

O&M variable costs (OMV)

- d.

CO2 emission cost: an exogenous or endogenous CO2 price from REMIND multiplied by the carbon content of a type of fossil fuel and divided by the conversion efficiency of a generation technology gives the CO2 cost of 1 MWh of generation. Note that, in REMIND, biomass is considered to contain zero carbon emission when combusted.

- e.

Grid cost: in REMIND, the stylized grid capacity equation is proportional to the amount of pre-curtailment VRE generation. So, the grid cost is effectively a variable cost. Note that, in future work, grid costs can be modeled in more detail either in DIETER or in another PSM. Here, we use the parameterized grid costs which are implemented in the default REMIND as an approximation to the necessary grid cost.

- a.

-

Power demand (convergence condition h4). REMIND informs DIETER of the total power demand dy of a representative year y. In the next iteration of DIETER, the exogenous time series for the hourly demand from a historical year (2019) is scaled up to the demand of the last-iteration REMIND, dy(i−1), such that the annual total power demand in DIETER is equal to that of REMIND for each coupled year: .

-

Pre-investment capacities as an additional brown-field constraint (see constraint (c8) in Appendix G). ER is the endogenous early retirement rate in REMIND.

-

Total regional renewable resources for wind, solar and hydro (constraint c2), such that DIETER capacities are constrained by the same total available resources as in REMIND

-

Annual average theoretical capacity factors of VREs and hydroelectric ones in REMIND (convergence condition h6). We denote the pre-curtailment utilization rates of VRE capacity as “theoretical capacity factors”, as these can be achieved in theory if there is no curtailment. They are usually determined by meteorological factors such as wind and solar potential as well as the efficiency of the turbines or solar photovoltaic modules. In contrast, the post-curtailment utilization rates of VREs are “real capacity factors”, as these are the real utilization rates after optimal endogenous dispatch. The time series of theoretical utilization rates of VRE generations of 1 historical year in DIETER are scaled up such that the annual average theoretical capacity factors in DIETER equal the exogenous parameters in REMIND:

In DIETER, to be realistic, the rescaled hourly capacity factor for solar and wind has an upper bound at 99 %. The slight mismatch of the capacity factors due to this additional upper bound is negligible.

3.3.2 DIETER to REMIND

The following information is passed from the last-iteration DIETER to REMIND.

-

Market values are , and the annual average electricity price is (convergence condition h3), where is the annual average market value without the surplus scarcity hour price and is the annual average electricity price without the surplus scarcity hour price.

-

The peak hourly residual power demand is a fraction of the total annual demand (constraint c7). This produces the peak residual demand in REMIND dresidual,y that is proportional to the last-iteration DIETER peak to total demand ratio together with the in-iteration total annual demand dy(i):

where was defined in Appendix H (Eq. H1).

-

Annual capacity factors of dispatchable plants (convergence condition h6)

-

Annual solar and wind curtailment ratio: curtailment as a fraction of total annual post-curtailment generation (convergence condition h7)

For the information flowing from DIETER to REMIND, we use an innovative method of multiplicative “prefactors”, which can stabilize the coupling and increase the speed towards model convergence. The prefactors are automatic linear stabilizers of the current-iteration variables in REMIND. They depend on current-iteration endogenous variables in REMIND and are usually multiplied usually by the last-iteration endogenous DIETER results that are exogenously passed on to REMIND. This allows some degree of endogeneity in these exchanged variables, and their values can be adjusted according to the updated dynamics in the current REMIND iteration, such as interregional trading or price elasticity of demand, under which the exogenous last-iteration DIETER optimality can be used as an approximate starting point but does not necessarily hold exactly.

The prefactors usually depend on the differences between generation shares in the two models: for example, the prefactor for markup is a linear function of the difference between the current-iteration REMIND endogenous generation share and the last-iteration DIETER generation share. We illustrate the mechanism of prefactors using the markup for solar as an example: a lower market value for solar is consistent with a higher solar share according to the well-known self-cannibalization effect of a decreasing VRE market value as the VRE share increases (Hirth, 2018). Therefore, we can introduce an automatic stabilization measure through a negative feedback loop: if the REMIND endogenous share is larger than in the last DIETER iteration, in which case the in-iteration market value should be lower than the last-iteration DIETER market value, the multiplicative prefactor for the market value should be constructed such that it is smaller than 1. This lowers the market value for solar and decreases the in-iteration REMIND markup ηy,s(i), hence preventing over-incentivization of solar generation using the old market value based on the last-iteration energy mix. Overall, this produces a stabilizing effect on the system by making the markup as a price signal responsive to endogenous quantity change. We use prefactors ubiquitously when passing variables from DIETER to REMIND, such that during the iteration REMIND can adjust more smoothly and easily. We discuss the implementation of these prefactors in detail in Appendix H2.

In this section, we check the convergence behavior for prices and quantities (capacity and generation) in coupled model runs using the convergence validation criteria from the last section. Comparing the numerical results with the theoretical prediction, we can confirm that REMIND–DIETER soft-coupling indeed produces almost full convergence.

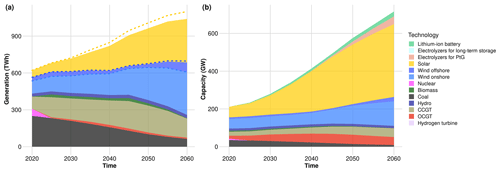

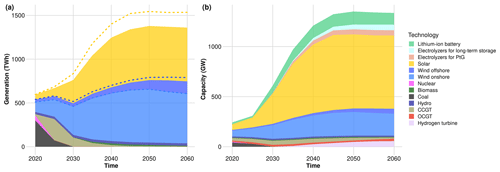

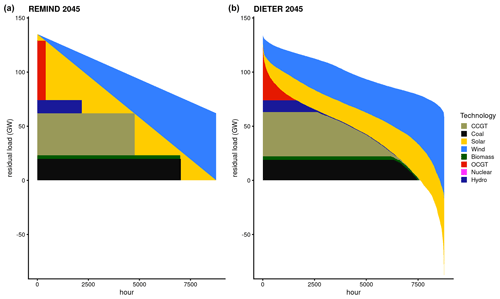

Throughout this section, we only use one scenario – a proof-of-concept baseline scenario. Under the proof-of-concept scenario of the coupled run, we disable storage (i.e., batteries and hydrogen) and flexible demand (i.e., electrolyzers) in both models, as this allows us to use the theoretically derived convergence criteria from Sect. 3, which would become overly complex in a model with storage and flexible demand. The coupled run is under a baseline scenario; i.e., there is no additional climate policy implementation. Since this is a configuration created only for comparison with the theoretical prediction, it is not meant to be a policy-relevant configuration. In more policy-relevant coupled runs, we turn on storage and flexible demand (see Sect. 5). For schematics and computational run times of the coupled iterations, see Appendix E.

For the coupled runs, we define a baseline scenario for the single region Germany under SSP2 assumptions corresponding to the “middle-of-the-road” scenario (for a definition of the SSPs, see Koch and Leimbach, 2023). Specifically, this means that REMIND runs for all global regions in parallel but that DIETER only runs for Germany. Only information in the German power sector is exchanged for the two models. We use a low CO2 price to represent “no additional policy”, which is USD 30 per tCO2 in 2020 and USD 37 per tCO2 for years beyond 2020. According to the 2011 Nuclear Energy Act of Germany, remaining nuclear capacities are set for early retirement in REMIND within the time period until 2022. We assume hydroelectric generation in Germany to come from running rivers. In DIETER, we cap the dispatchable generation's annual capacity factors at 80 % for non-nuclear power plants and at 85 % for nuclear power plants, so the dispatch results are in line with real-world power sectors. This constraint only adjusts the capacity factor constraint (c4), which would pose no additional distortion of our mathematical analysis.

Due to the particular implementation of offshore wind in REMIND, DIETER wind offshore capacities are fixed to those of REMIND to avoid too much distortion. Since in our scenarios offshore wind capacity in Germany is relatively small compared to other generators, this fixing represents only a minor distortion of the coupling. Hydroelectric generation in REMIND is assumed to have an average annual capacity factor of around 25 %. This capacity factor is implemented as a bound in DIETER. For simplicity, instead of a time series profile for hydroelectric generation, we allow the hourly capacity factor to be no higher than 90 %, meaning hydro is close to being dispatchable in all our scenarios. In the German context, hydro usually means run-of-the-river hydroelectricity, which has a variable output. Nevertheless, we find the 90 % maximum hourly capacity factor a reasonable assumption to make, since in our runs we do not yet consider pumped hydro as a technology in this study, so a more dispatchable quality of hydro can be assumed. Results presented in this section belong to the same coupled run under the proof-of-concept scenario.

4.1 Electricity price convergence

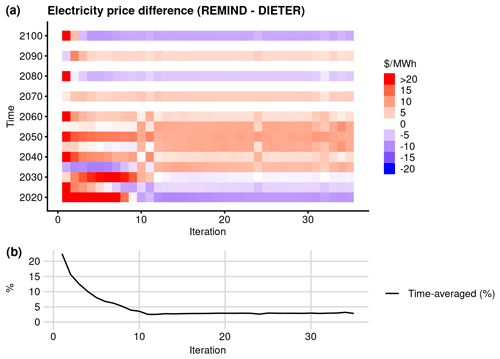

According to theoretical convergence criteria (under simplifying assumptions, Sect. 3.2.1–3.2.3), at numerical convergence, the electricity price of REMIND should be equal to the price of DIETER. However, REMIND is interannual intertemporal, whereas DIETER is only year-long, so we compare the differences over time as well as the interannual average of the price differences (Fig. 4).

Figure 4Annual average electricity price convergence behavior of a coupled run for Germany under a “proof-of-concept” baseline scenario. (a) The difference between the annual electricity price time series of REMIND and the annual average electricity price time series in DIETER as a function of coupled iteration. (b) The interannual average of the differences in panel (a) as a share of the REMIND price. Due to the interannual, intertemporal nature of REMIND, in panel (a) the price difference can appear to have oscillatory components, obscuring the visual assessment of convergence. As a result, we show the trend of price convergence over iterations more clearly in panel (b) by taking the temporal average of the price differences. The REMIND price in both plots is a running average of three neighboring time periods to visually smooth out oscillations.

In Fig. 4a, the price difference oscillates from period to period. As the coupling starts, the REMIND price is much higher than DIETER, especially in the earlier years. After around the 10th iteration, the difference in the early years starts to reverse: DIETER's price becomes higher than REMIND. Around 2040–2060, REMIND has a higher average price than DIETER due to the VRE market values being higher than their LCOEs. This is discussed later in Sect. 4.3.2.

In Fig. 4b, we calculate the difference between two time series – the time-averaged power prices in the two models. We observe that the difference between them decreases over the iterations, showing a clear converging trend, and stabilizes at around 3 % of the REMIND price. There are two observations regarding the price convergence of the coupled run. First, the convergence happens rather quickly within 10 iterations. Second, the converged value of the price difference is not exactly 0 but is slightly above 0, a few percent of the full price (a few USD per megawatt hour). Under ideal convergence conditions, according to (v1), the two prices should be equal at full convergence for every coupled year. However, in practice, the average prices do not match perfectly, as there are several sources of distortions from capacity shadow prices. The capacity shadow prices come from many sources in both models: extra constraints such as (c7)–(c8) that are not part of the analysis leading to (v1), constraints that are in REMIND but not in DIETER (c5–c6), and exogenous wind offshore capacity in DIETER. Some of these capacity shadow prices in both models can be more or less consistent with each other (such as the standing capacity constraint in DIETER and brown-field constraints in REMIND), but others are not and can distort two models in different ways, causing some degrees of misalignment in prices. As discussed before, prices can be overdetermined by the energy mix (Sect. 3.2.3). Therefore, some of the capacity shadow prices – even though not aligned between the two models – can nevertheless cancel each other out (especially when averaged over time), potentially causing the price differences to be moderate. To examine exactly how well the prices at the end of the coupling match, we need to check the cost decomposition of the prices. This is discussed later in Sect. 4.3.

Also note that Fig. 4b presents a time-averaged price comparison, and on average the difference between the prices in the two models is small at the end of the coupling. However, when one compares the maximal deviation for any single year at the end of the coupling, it can be as high as USD 10 per megawatt hour, e.g., around 2050 (Fig. 4a). This is much larger than the 3 % averaged deviation in Fig. 4b. However, compared to default REMIND prices (which we cannot show due to limited space), we are fairly confident that the oscillation of the coupled REMIND results from internal dynamics that are also visible in the default uncoupled version. So, a time-averaged treatment is adequate in displaying the total price convergence here.

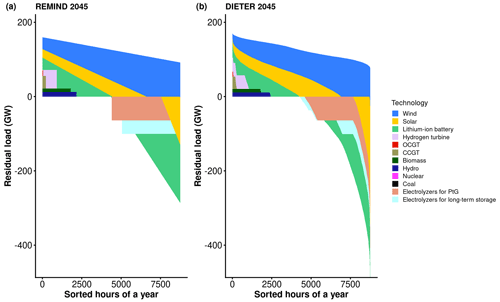

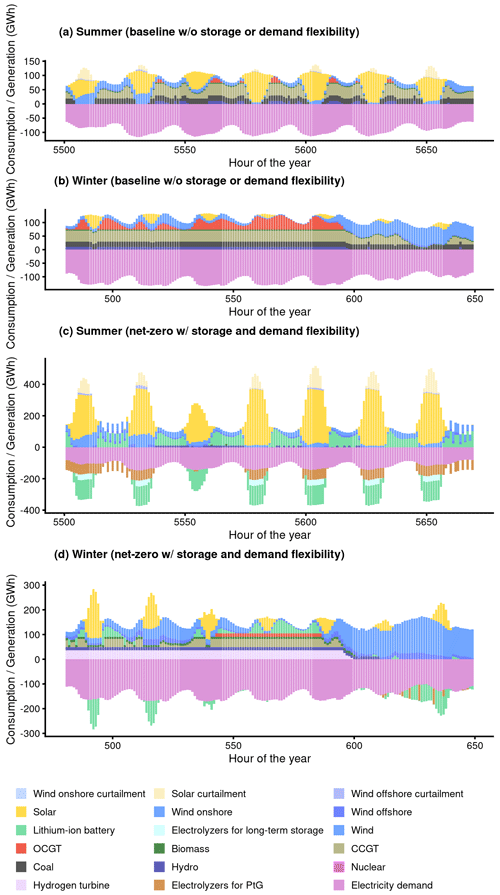

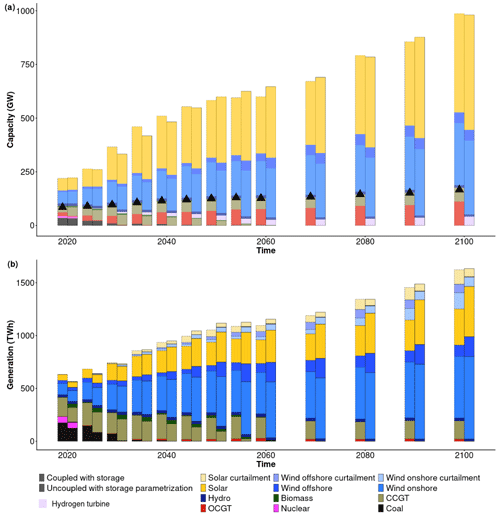

4.2 Quantity convergence